Closing a Fiscal Period

The fiscal period organizes all batches within that period, allowing staff to easily see all transactions, run a mass ledger, and recognize deferred revenue. Closing the fiscal period indicates that all batches have been reviewed and posted successfully, and that no additional batches or transactions should be added.

Note: Once a fiscal period is closed, it cannot be re-opened.

To close a Fiscal Period:

-

Navigate to the Accounting App > Setup.

-

Select Business Units > Click Edit.

-

Click the Setup tab > Fiscal Years.

-

Click Edit beside the Fiscal Year for the period to be closed.

-

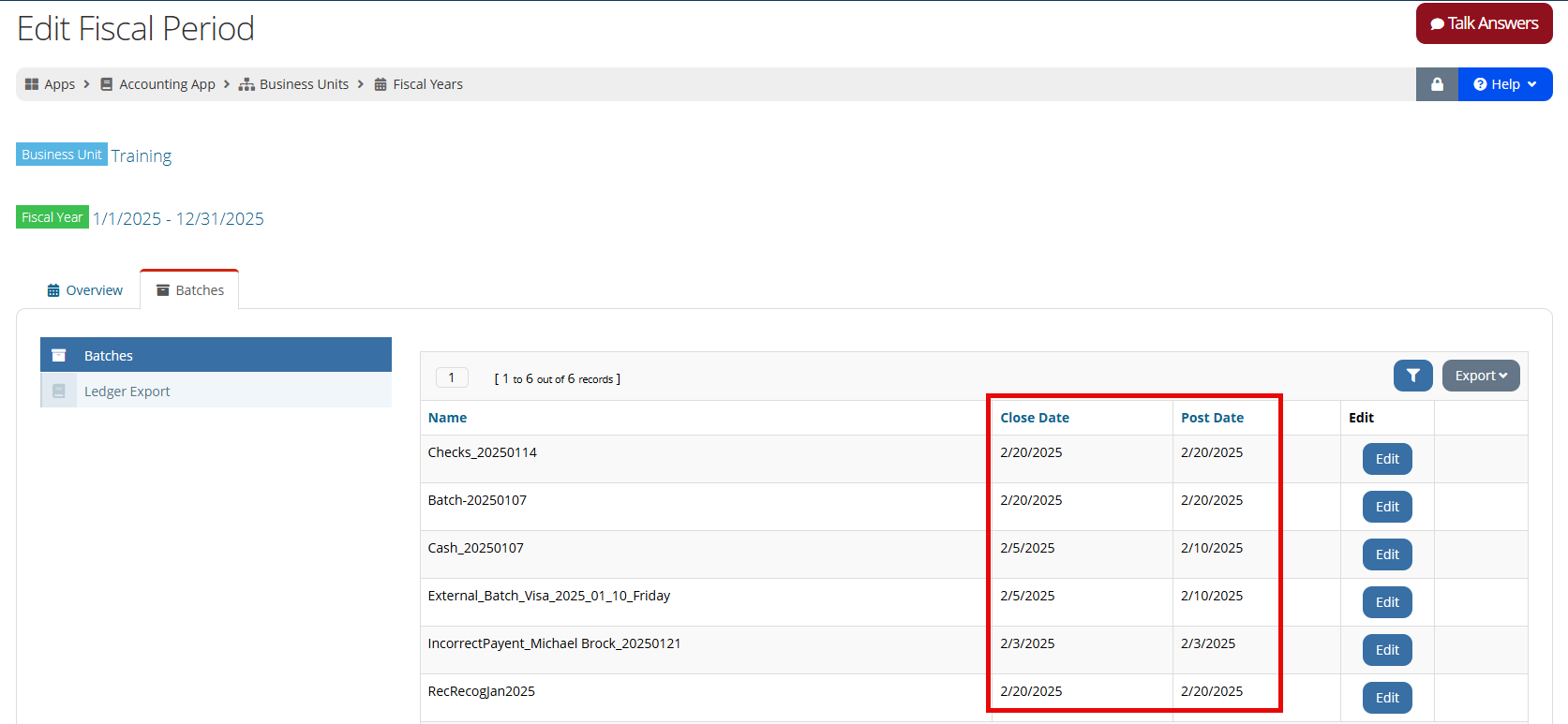

Click the Fiscal Periods tab.

-

Locate the oldest open fiscal period and click Edit.

-

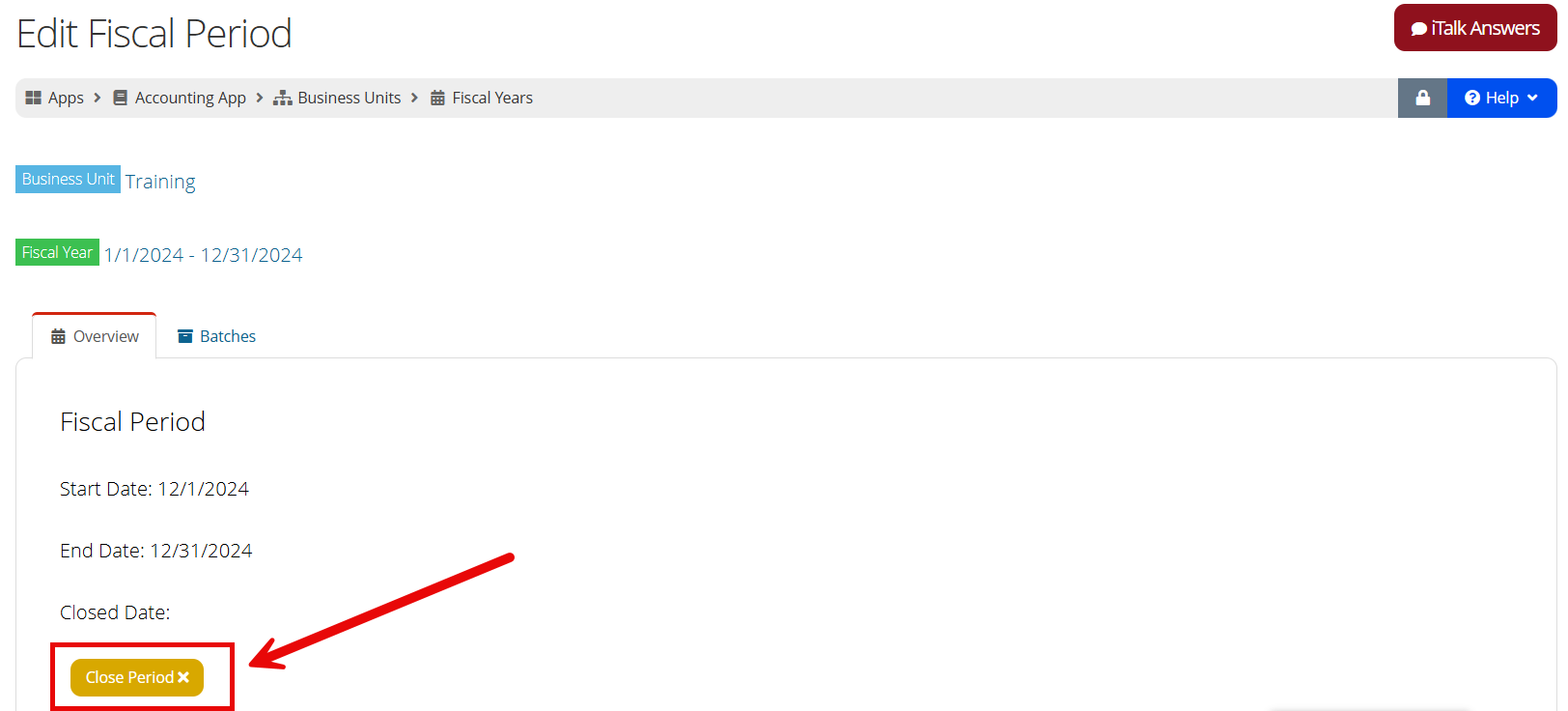

In the Fiscal Period:

-

Ensure that all deferred revenue has been recognized.

-

-

On the Overview tab, click the Close Period button.

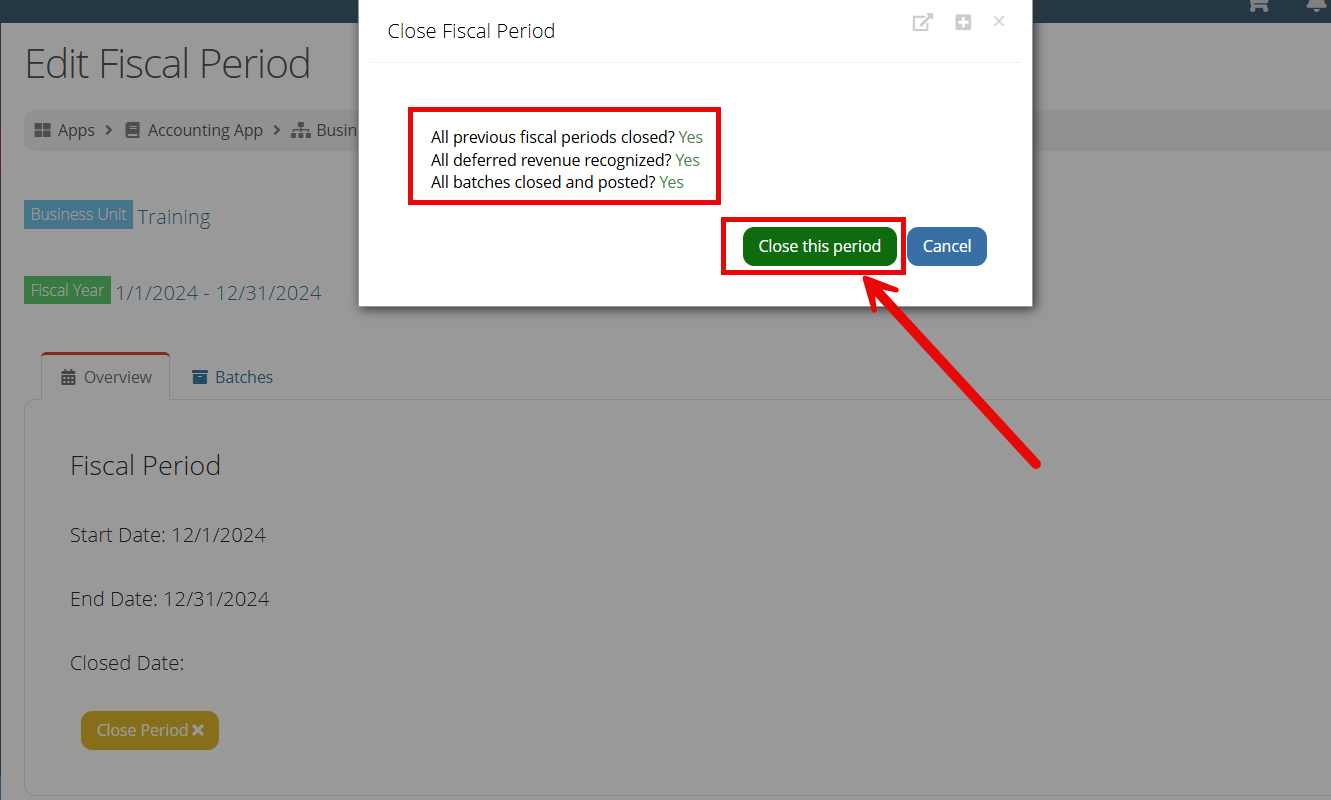

The system automatically checks whether all previous fiscal periods are closed, all deferred revenue has been recognized, and all batches are closed and posted. If the fiscal period meets all of these qualifications, click the Close this Period button.

The Closed Date will appear on the Overview tab of the Fiscal Period.

Recognizing Deferred Revenue

For clients deferring revenue recognition, this also takes place on the Fiscal Period, prior to closing the Fiscal Period. For more on deferred revenue recognition, see Recognizing Deferred Revenue.

Closing a Fiscal Year

Once all periods in a fiscal year are closed, the fiscal year is automatically considered closed.

Note: A fiscal period is subset of the fiscal year, and allows for the management of batches and recognition of revenue within a specific period of the fiscal year. Batches in the system are organized and linked to fiscal periods. Typically there are 12 fiscal periods within a fiscal year.

See also: The Month End Close Process